Doing The FINRA Jig

A Documented Journey

Don't Let This Happen To You

| The following is an account of actual events. The stock advisor, broker, places and names have been omitted. |

Positioning:

It was the summer of 2013. My wife and I had a REIT that became liquid. Our REITs were investments made around six years ago from rolling over 401ks and pensions when we had worked, the full amount of this one REIT in two checks from an IRA.

Over those six years, as a retired couple, we were able to receive a monthly distribution of 7% to 8% to add to our cost of living beyond Social Security for a nice gain of about 42% on our original investment. Again, that original investment was now being returned to us in checks we would send to a new broker situated in a mid-Atlantic state for reinvestment into another IRA.

The original broker of the REIT was located in the northeast where we had lived and worked for well over two decades. Having been with this broker for over 12 years investing in other REITs, we decided to invest with a different broker in the geographic area where we recently retired. We wanted to compare the brokers to see if the new one would provide better services with an equal or better monthly distribution to continue supplementing our cost of living.

As former school teachers who entered the business world late in our lives while having raised six children, we still have a mortgage and now live in a small retirement home. Our basic living budget is as follows:

23.7% (mortgage / utilities / home repairs), 7.1% (communications / digital services), 6.1% (auto insurance / repairs / gasoline), 8.2% (medical, annual advantage coverage), 8.2% (groceries), 12.4% (driving vacations, gifts to family, entertainment + eating out, misc Jesus factors), 4.8% (donations), 9.5% (federal and state taxes), and 20% (savings to pay off our mortgage.)

We own two used cars and have zero credit card debt with no other outstanding loans. Our credit rating is 800. Our mortgage is 3.6% fixed 30-year loan that our bank, by coincidence, bought up from another lender. We have no other assets outside our home, cars, and REITs investments that are not in the stock market other than the one in this discussion.

So with our budget we're still able to make cuts if necessary. While our REITs are called high risk, we had watched mutual fund investors lose 20 to 30% of their investments in safe stocks in the 2008 crash while we didn't lose a dime.

However, as other REITs become liquid probably this year, we plan to begin investing in other areas that will include around a 7% distribution. That should provide us with enough money outside our social security to pay for a rest home in the next decade if it would become necessary. We don't want to turn over our assets to the government for sub-standard retirement living after seeing our parents go through that with the little money they had and institutions keeping them semi-drugged 24/7.

Our Instruction And Goal To The New Broker:

Our two IRA checks had been mailed to the new broker so that our hands would never touch the money, allowing us to show on our 2014 taxes the investment had gone into another IRA.

The broker was part of a large banking firm that already had our savings, checking, and our mortgage along with a trust division to execute our will. We thought with that much business, the bank's stock broker would look after us with a keen eye.

We had our first meeting, after the checks had been deposited with the broker, to discuss our goals. One goal, which we didn't discuss with him, was for a one-year investment to see the results of his actions and decisions to protect our retirement money. With other REITs becoming liquid possibly at the end of 2014, we needed the information as to which broker was the best to watch over our retirement money.

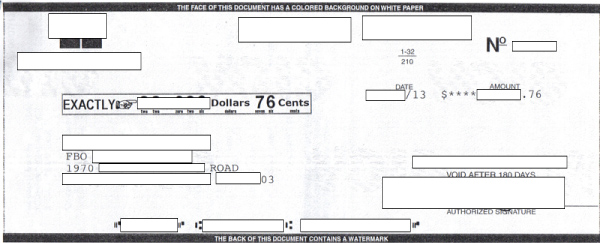

Copies of the two checks sent to the broker from the REIT that became liquid

Again, the REITs we were in had NOT been related to the stock market, an investment we understood that needed to mature while we worked. After around six to seven years with an excellent monthly return on distribution, each REIT would be made available for sale to a third party. As a point of information, in the case of a former REIT it was bought by the huge real estate investor.

Once this current REIT was sold, the investment was made liquid and returned to us as cash for reinvestment. Since it was an IRA, the cash was moved (see form below) and reinvested as an IRA with the new broker.

We advised the new broker we were interested in another REIT with at least an equal distribution we could depend on for our living costs and savings to pay off our mortgage. We told him we hadn't been near the stock market for 12 years and wanted to know if there was a way to protect our IRA investment.

He told us there was a way. He called it a stop loss.

He told us a stop is set if the stock were to drop down to a certain level, protecting the investment we were entrusting him with. He never said where that stop would be or who chose it, our therefore thinking it might be a computer action.

He told us he preferred safe bonds or mutual funds that might get us a distribution of 4% or less. But we said as long as the stock he would recommend was not expected to go belly up, (we know there are no guarantees), we had no problem with a REIT.

Our investment had already grown with our 401ks and pensions. We were looking instead for distribution in retirement, understanding that what goes down can come back up. But with a stop loss we figured a loss would be minimal allowing us to get out and look into another investment.

He first recommended one REIT, then a few days later changed his mind to another with a 11% distribution every three months. We accepted his trust to watch over our hard-earned IRA that we were putting in his hands. He then invested our money in a company called DX Capital around June 10th, 2013, the value at 10.1

We went on our way thinking not much more about the transaction, looking forward to our first distribution at the beginning of November. That is the way it was with our original REITS for over 12 years, again those not in the stock market.

History Of Investment And Later Discoveries:

Then on August 6th, (according to exact records we didn't have until February of 2014), our stock hit its first stop loss. The broker called us and asked for permission to sell and hold. I said fine per his advice in protecting our investment.

I asked him what the stop loss was that triggered this event. He said it had reached 9. We had bought the stock at 10.1, so that was at least a ten percent loss in our investment. I asked him why it was set so low to allow that much loss of the investment we had given him. I said I thought a stop loss was to protect the investment by not allowing it to drop that much.

Then on August 23rd when the stock rose again, he bought it back setting a new stop loss. Meanwhile we hadn't seen any e-mails on the transactions and didn't think any more about it, believing all had finally settled down.

Then nearly two months later on November 5th, (again according to exact records we didn't have until February of 2014), he sold the stock again when it reached the next stop loss. This time the stock was below 8.5. In a few days he bought the stock back when it went up.

Then about three weeks later when watching the stock online, I saw it drop to 7.9. This time I called the broker and asked, "Did you drop in a stop loss?"

He said the stock had gone back up to 8.0.

I said, "But what if it had gone down instead to 7.5?"

Then I asked something with new concern. "How much are these stop losses costing us? I've seen online trades on television well under $100 dollars a trade."

The broker laughed on the phone and informed me these trades cost thousands of dollars.

I was stunned, not knowing what to say on the phone. He must have picked up on my silence and realized he had never told us the price of these stop losses or maybe didn't want to. I write this because we would find out later after filing a complaint that the stop loss actually had another name. It was called a 'broker's commission.'

He broke the brief silence on the phone and said, "I have a pit in my stomach. I'll tell you what. On the next stop loss, I'll eat it."

I replied, "Eat what? We never knew these stop losses were costing us thousands of dollars. And the stop loss was to protect our investment. We bought at 10.1 and now the stock is at 8.0. How did your suggestion back in June protect our money?"

I then said, "No more stop losses." The stock later dropped to 7.3, and then started to rise again past 8.0.

Because of my discovery of what a stop loss was, I began to wonder if the broker had recommended a stock he knew would hit the stop losses to create commissions for him since the cost was never mentioned.

In early December with a pit in my stomach, I called my bank's national phone number, asking how could I find out who would be responsible for managing a broker. They gave me the e-mail of a regional manager. After I e-mailed the question to the regional manager, he then e-mailed the area manager, who then had his assistant contact me. The assistant later said he could file a complaint with the compliance district for the area, asking what our complaint was. I indicated that while the stock had gone down that wasn't my complaint.

My complaint was that the broker had told us a stop loss would protect our investment. Not only did it not protect our investment, now losing well over 20% of our funds, but he was charging us thousands of dollars we were not aware of. This cost was not discussed in the original meeting in June, nor at the stop losses. You would think he would have said on the phone at the first stop loss, "You know this is costing you and your wife thousands of dollars." But those words never came out of his mouth for any stop loss.

It was getting near Christmas and the assistant manager had finally contacted the compliance division of the bank. At the same time I began to investigate, trying to educate myself in other stocks that would have met our original request with the broker in June.

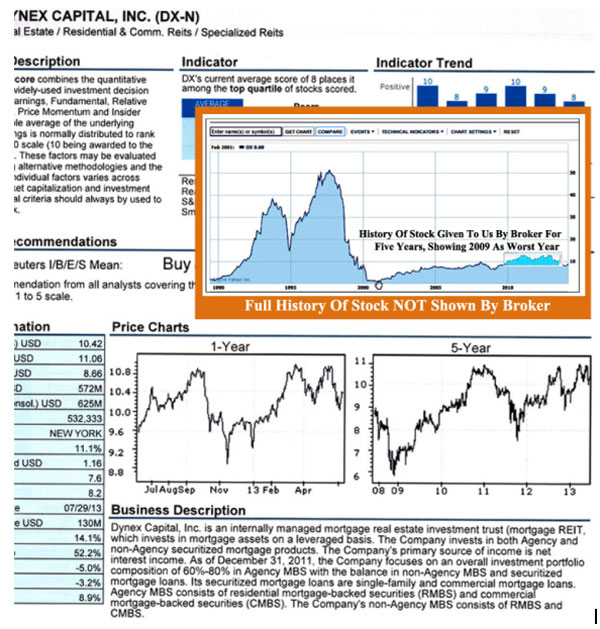

I first looked at the DX stock for five years, a chart provided online. Here is where we bought it back in June. Look at the hand on the chart.

Then I looked at the same stock on its five-year chart. Below is what I found. I was stunned. Not only looking at the stock's five-year history, one could easily see the stock was probably ready to go down.

But then I looked at the stock the broker selected with its full history shown. What I saw was unbelievable. (see below.)

I discovered in this graph the stock started in 1990, rose to over 50 points and then dropped in February of 2001 (see upper left of chart) to a value less than 1, or 69 cents. The stock started to rise slowly again reaching 10 points in February of 2008. Six years later our broker would recommend it for our investment with it showing little to no growth for six years. Stunning stuff.

Our broker never showed us these easy-to-read charts on the past history of the stock. He instead, at a meeting near our home, gave us a mound of paper we had no idea how to read.

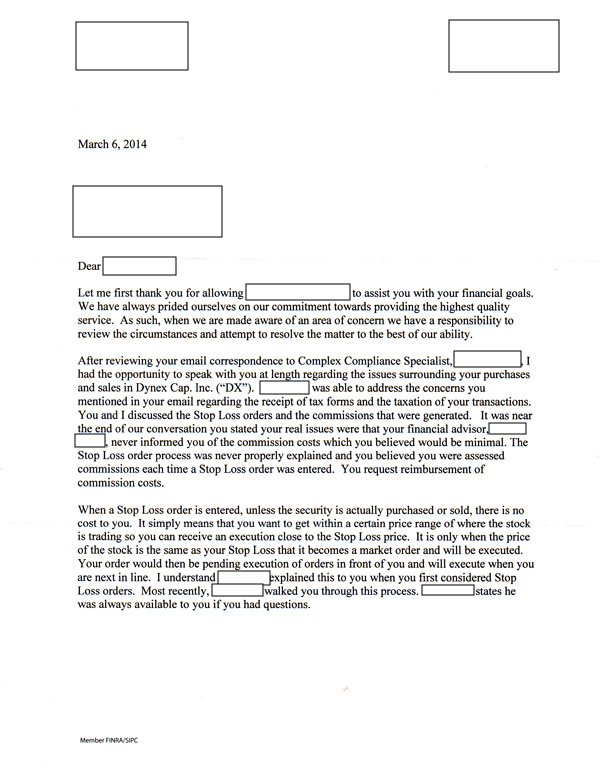

Moving on to January 2014, two letters arrived from the regional compliance office concerning our complaint to the assistant manager, the first one written January 13, 2014. It was encouraging. We were looking for a resolution for the cost of the stop losses we had not been advised of by our broker in June or during the stop losses themselves.

The next letter arrived, written January 29, 2014. I was surprised, as no one from the bank's compliance office ever contacted us for details on our original complaint. Here is what it read:

Our bank had stunned us again. The letter read that the broker's fees "had been fair and competitive," and therefore our complaint had no justification. However, the broker's fee being fair and competitive was never the issue. The issue was the broker had never, from June through November, advised us what those fees would be.

I then e-mailed the area manager's assistant and asked that we be removed from our broker so no more funds could be taken from our account, now almost a third of our investment gone. We still didn't know the extent of exactly what those stop loss fees were or how many were activated. I thought two, maybe three. I also asked for a few recommendations of other brokers who could take over our account in the investment location closer to our home.

On February 18, 2014, my wife and I met with the area manager, who said he was now taking over our account and wanted us to sell what was left of our investment and put it into a safe fund with maybe 4% distribution. While the manager tried to look like a hero by taking over the account, we would later discover that it is basic bank procedure for the area manager to take over a troubled account.

In the meeting with the assistant manager in attendance, I told the manager that I had looked at other similar REITS and was shocked at what his broker had sold to us last June. I found four other stocks that had done better than the DX he recommended with two actually making money based on comparisons.

He pushed my comment off, saying it didn't matter, that the investment we had for 12 years was a risk and we should never have invested in it. I told him the distributions came every month without fail and without losing a dime when the market crashed in 2008 and many mutual funds lost close to or over 1/3 of their value. I explained that the reliable distribution covered our cost of living since we had retired to the area.

He assured us that he was protecting us and suggested we cut our living expenses to get by with 4% or less distribution. Since we had been living off of 7% and 8% since we retired over 7 years ago, that would mean cutting our costs by 50%. We still have a mortgage that we want to pay off with the distributions, which would give us $650 more dollars a month.

We left the meeting feeling slapped around at 73 years old. Again, there was no response as to why the broker had never told us the stop losses were several thousand dollars each or why the broker didn't give us other options to invest back in June of 2013.

While preparing the following information for the meeting, I accidentally noticed when online viewing the DX stock there was a button labeled, More stocks like this.

Wow. I couldn't help thinking our broker could have done this with little effort. In June he had never given us a choice of other stocks and never showed us these online trends you are about to see.

Below is what I found online. I showed the estimated balance of these four other stocks at the area manager's meeting matched along with the DX stock the broker had recommended to us, the investment time from June 10 to February 14th on all five for apples to apples.

When looking at the online stock charts below, note if the NMM had been recommended back in June we would have probably not had any stop loss with the value of our investment increased at the same time. The same for the stock, MCC. The other two would have lost us money but $3,000 less than the stock the broker had recommended. All provided quarterly distributions of 9 to 13 percent.

Finally, when at the meeting the manager still didn't know how much we lost in stop loss fees to his broker, thinking possibly $5,000 for six incidents. But the next day I contacted his assistant manager using e-mails. He had always been helpful and exhibited the behavior that I would have expected from the bank toward a loyal customer. I needed to know the answer that no one had given to me. Exactly where were those commission costs that were supposed to have come to us? I could never find them in my e-mail.

He said that the broker might have assumed, (a very bad word in the corporate world), that since we were online we knew how to find the costs of the broker's commissions.

After the assistant manager and I e-mailed each other a few times, I finally got the instructions on how to find the cost of the commissions. Without being trained by the broker back in June, there was no way I would have found the cost of his commissions because of all the screens necessary to get to those final charges. The process is nothing at all like the ease of online banking.

So how easy was it to find the stop loss commissions vs. online banking on its Web site?

(Note: We noticed in July of 2014 the institution has changed its online screens from the ones shown below.)

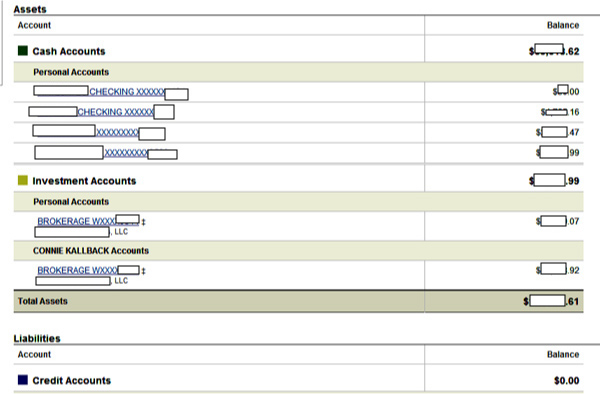

The online banking screen lists all your accounts at the bank. Simply clicking, for instance, on your main checking account takes you immediately to your checks and deposits. But the investment activity screen was a whole different ball game. We were shocked no one had taken us through it until near the end of our adventure.

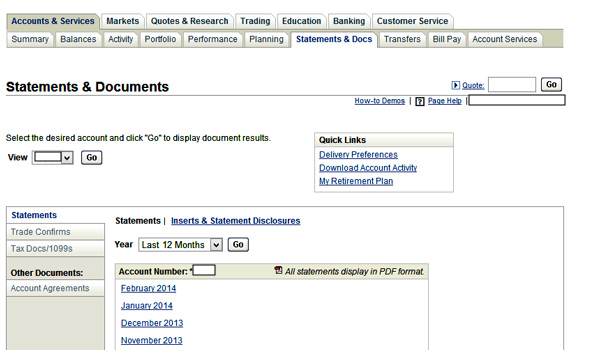

First, when you get to the investment screen you see the value of your investment, but there is no link to see commissions. On top of the Web page are 17 tabs. One of those has the commissions. In my earlier clicking on each of them in attempts to find the commission charges, I found two tabs were errors that took me offline.

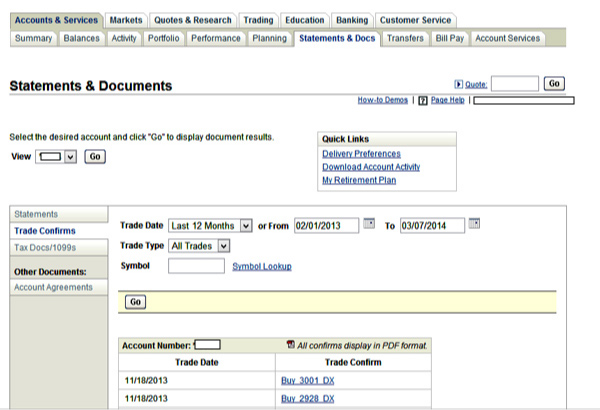

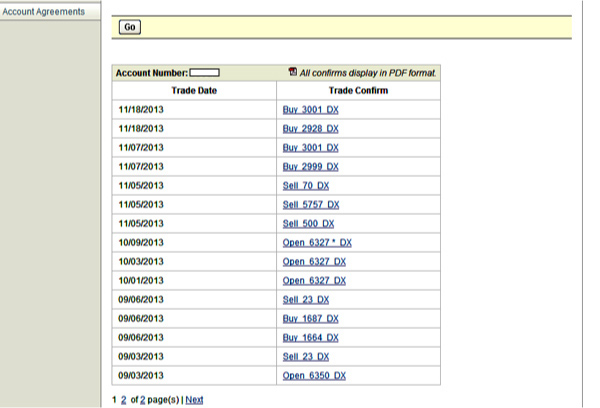

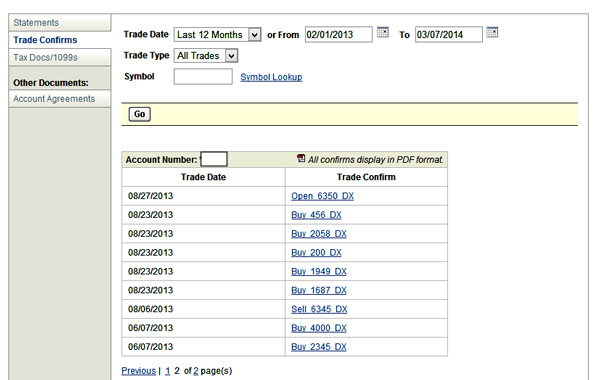

I discovered with the help of the assistant manager that the tab I was supposed to click on was "Statements and Doc." Then under that tab I thought I would look for commissions or stop losses. Those words were not there. The correct link on the page, I discovered with the assistant manager's help, required scrolling down and looking for the link labeled, "Trades." Once clicking on that word, I saw activities by date for "buy, sell, or open."

There were 24 incidents on two pages by one account. As a novice we would have had to know the exact dates of the stop losses to pick the correct ones out of the 24 while ignoring "open," coming up with either four instances for two stop losses or six for three.

So after eight months I would finally discover the cost of those trades and how many were made. First, here is how the online banking looks. Click on any blue link and your account comes up. That's it.

Now for the broker screen. Watch how this screen is nothing like the online banking. There is no way anyone would assume if you knew online banking you could just breeze through it and find the cost of the broker's commissions. Check this out.

First you have to go to the broker tab that brings up this screen.

Then under the above screen you have to find and click on "Statements and Docs."

Then you don't look for the word commissions or stop losses, instead the words, "Trade Confirms." Click on the link.

Then to find all the trades by date, you scroll down on the same page to see the following.

But note the message on the bottom of the screen, page 1 of 2, so you have to click on 2 to complete the list of activities since June 2013.

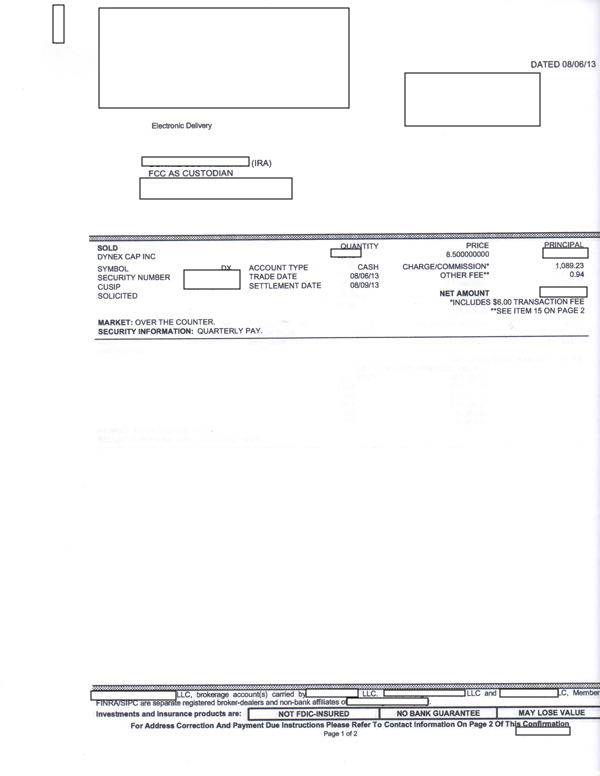

From these two screens you have to then determine how many trades and how many buys from the 24 activities listed, obviously ignoring "open." I had no idea how to read these, some canceled, some for around $100. The assistant manager looked at all 24 at his office, as I was looking on screen at home. He wrote back saying there were four incidents, two sells and two buys for each account. He told me the dates to look for. I then went to those four, printing the following report for one "sold" activity on August 6th.

There were three more forms, one matching this one with a "BUY" and then four more on the other investment account for the same SOLD and BUY dates. That gave me a total of four incidents, not six, for each, as had been speculated in the meeting. And the cost against our account for broker commission and fees was not $5,000, but over $6,100 and change.

Several weeks later at the end of February, I got a call from the legal department at the bank, telling us that the compliance department was no longer involved. I was happy to hear that because they never got it right in the first place."

The manager for the legal department then asked me what I wanted.

I said, "While we understand we have to live with the stock he advised us to buy, even though he never gave us several choices with stats laid out, we would like to have our $6,000 returned based on false information or actually the lack of it over an eight month period . . . that even the area office manager didn't know the final amount until about two weeks ago."

The manager on the phone said she doubted that would happen. I replied with the basic facts saying in effect . . .

"Whatever you decide, investors need to know how easy it is to lose thousands of dollars through information hidden by a broker while his employer protects him at all cost. Therefore, I think I should inform the investing public on the Web what my wife and I went through, and that if a broker says stop loss and doesn't give a cost, run out the door."

I also told her FINRA, (Financial Industry Regulatory Authority), might also be interested in how a large bank was operating in FINRA's field of regulations, not advising customers the meaning and cost of a stop loss. But that may be for another day in the near future. The manager seemed irritated, but I always like to lay my cards out so that no one can say later they didn't know.

In the end looking over what had happened, the broker had put the first stop loss without ever advising us at 9, after we had bought the stock originally at 10.1. As I have shown in this report, for the NMM stock a stop loss would probably never have been needed while we would have increased our investment. We thought the stop loss would have been put under but close to the value of the stock, so we could take a breath to see where it was going with only a minor loss. But the area manager in the meeting said in defense of the broker he would have put the stop loss at 9. So there you go with respect for client information out the window.

However, what I didn't discuss with anyone is the chart below for the first stop loss. As you saw in the above commission report, it was dated August 6th, supposing to have sold our stock when it dropped to 9. But look at the DX chart for August 5th, the day before and its value shown in the upper left part of the screen is $8.45.

On August 5th the stock was already below 8.5, forget 9. In fact it had already dropped below 9 before July 29th. See the hand below in the chart, the upper left showing the value of the hand at $8.78 on July 29th.

In summary, our investment is now down to around 70% of value. The $8,000 annual distribution we were looking forward to receiving was going to pay for our federal and state taxes in April of 2014. But because of the stop loss charges, actually commissions by our broker, that $8,000 was trimmed to $2,000, with $6,000 going to line the pockets of the broker and the bank.

We had already received $4,000 of the distribution, now eaten up by the stop losses. The final $2,000 is expected at the beginning of August of 2014. Today is March 7, 2014.

As a final cap to this story, the financial institution's legal department created a response on March 6, 2014, that arrived at our home on March 11th. Here is the actual two-page letter with names, dates, and logos removed.

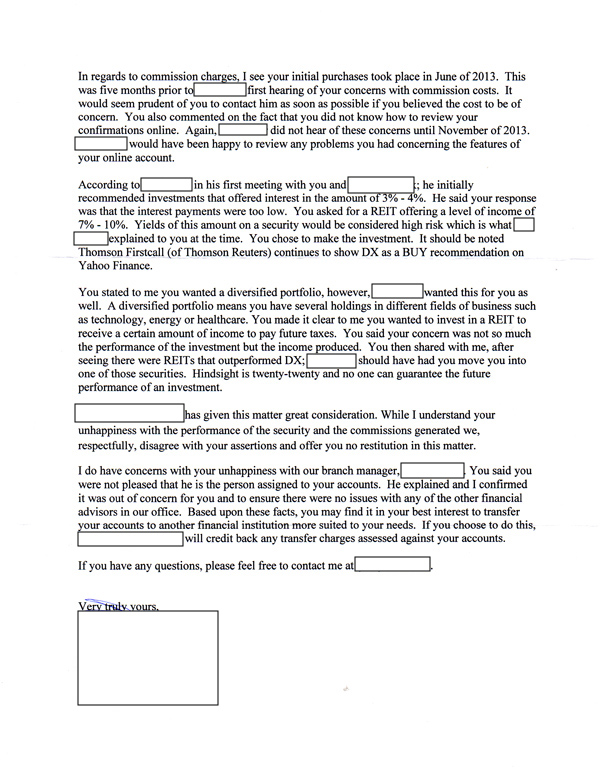

As one can read above, the institution's legal department advised us . . . you may find it in your best interest to transfer your accounts to another financial institution more suited to your needs.

First, "accounts" is an interesting word since we have one investment account, (the one that this URL focuses on), three checking accounts, one savings account, a mortgage that this institution bought from another company that held our mortgage, and a service to handle the distribution of our assets in the event our deaths. It also agrees if we sell our investment, the firm would credit back transfer charges but not the expensive commissions, commissions we were not advised of until asking further questions of the broker in late November, the broker having three opportunities to educate us on this expense since June 2013 and did not.

Ironically, to sell and transfer the account we had given to this institution at around a 30% loss today, we would be returning it to the original investment firm that had sent 100% of the sale of a REIT to this institution, a firm that held our investments for over 12 years with a constant monthly distribution of around 7% with zero losses in the crash of 2008.

However, we continue watching the DX account because that is the only REIT this institution's broker ever recommended to us, a broker they obviously believe holds their corporation's values in dealing with customers and their valuable retirement investments.

As Paul Harvey would say, And that's the rest of the story.

Original Online Document Finalized 4/13/2014, 11 P.M.

__________________________________________________

Addendum 1

A. Below is an e-mail that was sent to the financial institution's local regional manager on May 2, 2014, at 4:40 P.M., concerning quarterly distributions that had yet to appear in our main checking account.

After our continued complaint to the financial institution about its broker never advising us of the cost of putting a stop loss on our stocks in June of 2013, the broker's suggestion, the regional manager took over our account in February of 2014 after we had specifically asked instead for a new broker in the office nearer to our home.

After the e-mail was sent, that evening I noted the quarterly payment had been set to be posted to our main checking account on May 5th.

However, there was no reply to our e-mail nor to our continued request for a broker that was not a regional manager. We had wanted someone that would be dedicated to our account and not busy monitoring all the accounts in the region. Our concern was that if we wanted to sell and the broker was out of town at a national or regional meeting, or on vacation, the request could sit in an e-mail account or in a phone message center for hours if not a day. Again, we have not been provided with written confirmation on who to contact in the event the regional manager is out of the office.

B. About a week later an unexpected postal letter, as shown below, showed up in our mail box from the investment firm's regional headquarters. It seemed to try to answer the questions we had sent to their district manager in the above e-mail, which to date had gone unanswered.

Obviously the above e-mail had instead been forwarded by the district manager to corporate for an 'official' reply. To that end the letter demanded we sell our investment, an investment that was now around a 33% loss from a stock originally recommended to us by their broker back in the summer of 2013, the letter noting that while we would be charged a fee for the sale it would be reimbursed to the account of our new financial institution [at some later time] in the future.

This corporate department also acknowledges our quarterly disbursements have been transferred, as if we had no concern when originally writing the e-mail. However, with our account now under the thumb of the district manager, this corporate department never contacted us before writing the letter to discover we had been looking for a notification that our distribution would be hitting our bank account, which had been the practice.

Since the notification never came, I went into our accounts online and noticed our distributions were showing up with our investments. My concern was they would be buried there and not transferred to our checking account. That's one of the reasons I sent the e-mail to the district manager in the first place, who again controls our original investment. I noticed the day after I sent the above e-mail that the distributions were suddenly placed into an activity that would transfer them to our checking account on the following Monday.

The same aloof attitude had come from this same corporate department back in late December 2013, when it wrote us the broker's postings were in order. But that was never our complaint at the time, instead concerned about the thousands of dollars in fees that had been removed from our accounts as commissions we were not aware of. If they had contacted us, we would have told them. But as then and now, they didn't.

[Note: One of our requests in this e-mail was to be assigned to a broker away from this busy district manager, who had taken over our account without our permission. Since we never received a letter or e-mail from the district manager via our first and only meeting with him in February 2013, advising alternative contacts in case he wasn't available if we wanted to sell our stock, I was writing again requesting a broker's name. With the above e-mail to the district manager being forwarded to corporate instead of answering our questions, we obviously no longer have a local contact we can communicate with.]

Therefore, with this new letter we discovered their arrogant attitude was simply standard procedure to protect the corporation, advising us their huge investment firm had now washed its hands of all embarrassment and responsibility for our money and the way it was handled.

Meanwhile, you can see by the text in the last letter that the environment towards our complaint by this national investment firm after about a year had turned hostile. We had initially only wanted to know why we were never advised of the thousands of dollars in fees taken out of our account, (associated with what the broker had called a stop loss), fees the broker on three previous occasions could have made us aware of. Only later did we discover each stop loss and buy had costs us around $3,000.

Maybe to this huge firm it's only chump change. But to us it's our hard earned 401ks.

__________________________________________________

Addendum 2

A. Because of the recent toxic letter from the investment firm's corporate office, we have filed a complaint with FINRA so our experience is at least recorded.

However while waiting for a response from FINRA, we decided to reach out to the CEO of this huge financial firm with a letter sent UPS overnight, allowing him to read our documented Web page warning readers to be aware that even well-known investment firms can use undisclosed fees as profit, then blame the customer for what their broker refused to explain about his own recommendation.

In our letter to the CEO, who is located on the West coast, we simply explained who we were, the financial programs we were involved in with his company, and that we were stunned at the attitude we met at his company's investment division. We made no further comments, providing this URL in the letter, saying we were not looking for help but to advise him if he was interested in what was going on under his watch.

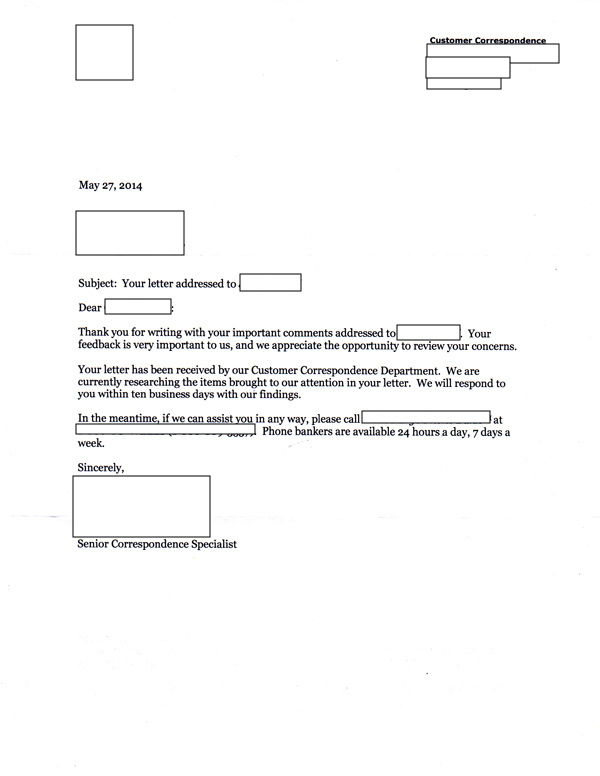

To our surprise, we never received acknowledgement from the CEO's office but instead from a specialist located in another part of the country, the employee's letter shown below.

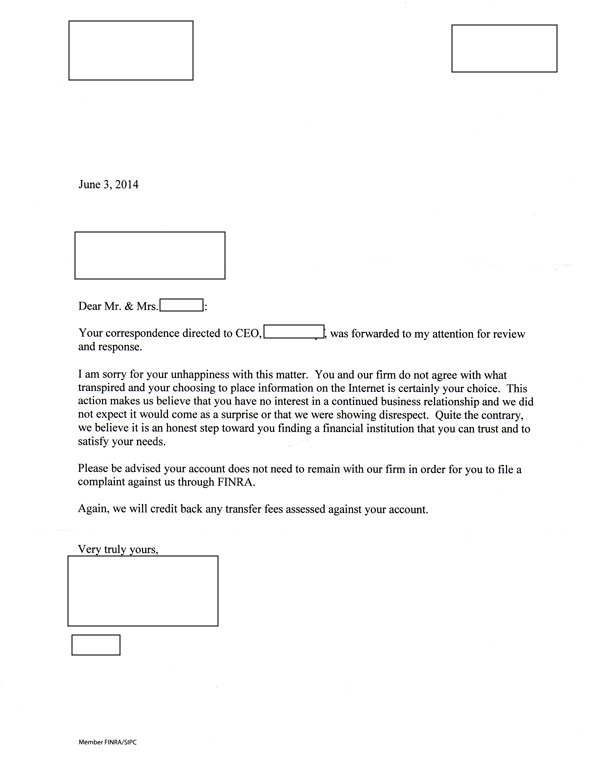

Then within a week, we also received another letter from the institution's legal department, the one that had consider us as hostile customers, acknowledging they knew we had sent a letter to the company's CEO and that we still needed to transfer our account to another firm, the cost of that transaction to be applied to our new investment firm sometime in the future. Here is that letter again with the address, name, and company logo removed.

We continued to wait for a reply with the investigation passing the ten-day promise of return, our also still not hearing from the CEO's office. Finally after around 30 days, we sent a letter to the specialist, who had replied to us for the CEO, asking what had happened with the promise of researching our complaint within ten days.

Here is our letter sent June 23rd, our still waiting for a reply as it went to the post office.

B. We also advised a FINRA rep that we had sent a letter to the investment firm's CEO, providing attachments for the record, our still waiting to hear from FINRA on our documented online complaint.

C. To summarize once more how we got here, in a previous comment in this URL I had mentioned the district manager had called us into a mid February 2014 meeting, telling us he would now be our broker, our having written we wanted to choose our own from this district office that was closer to our home. At that meeting, where he had demanded we move our investment losses under his broker's watch to another stock with much lower distribution, I also realized that action in effect would negate our original complaint against his firm.

Again, we had advised him at the time we needed the distribution funds for our daily living costs above and beyond social security, concerned about those payments if one of us were to die. He had told us to cut our monthly cost of living in response to meeting his recommendation of a lower distribution, his obviously not knowing what those costs were. With our having a small mortgage, no car loans, and no other monthly debt with a credit rating around 800, it was hard to know where to make major cuts. We take an annual driving vacation for a week and don't belong to any country clubs. Of course we have the usual expenses of a family with grandchildren, events such as weddings, while putting up friends who come to visit us, which is rare.

Since the February meeting he has chosen to never contact us again, my adding these updated comments on July 9, 2014.

As I had noted earlier, we had recently e-mailed him looking at the time for our distribution to drop into our checking account, which it hadn't. I also reminded him again we wanted to chose our own broker. Instead of hearing back from him, we got another hostile letter from the financial division's legal department to remind us we needed to move our money to another institution, no longer welcomed because of our original complaint.

Recently some friends, also retired, had mentioned to us off the cuff at dinner that they had pulled out all their investments, our discovering it was from the same financial institution we were now in contest with. They believed their interests were not being served and not surprised when we told them of the arrogance we had encountered. They then advised us that the district's finance manager had been on the county's school board, which explained his heavy handling of us during our dispute. We discovered he is also on the board of a state university. While we admire people that serve their communities, we also know that kind of power can create horrible egos.

So that is where we are today, 13 months after our original investment and six months after our complaint, proving again that life is still a journey and never a guided tour.

__________________________________________________

Addendum 3

Again, the CEO of this huge firm has again refused to investigate how we were treated by the legal department of his company's investment division. Instead the national CEO has allowed that same legal department to become judge and jury over our complaint, as indicated by this new letter of July 18, 2014. It again refers we had received transaction confirmation when we have already shown above we hadn't been taught how to access that information until late February 2014, nine months after we had made our investment.

Even when finally being able to access it, we found around 18 postings, the transaction we were looking for buried somewhere within them, our never getting the cost directly in an e-mail and therefore never aware of the thousands of dollars that had been taken out of our account.

And as before, the legal department refuses to address our never being told the dollar amount that went along with the broker's recommended stop loss to protect our investment, it worth around 2/3 of its original amount 13 months later with the broker having several opportunities to do so.

Finally, since the regional manager has taken over our account since mid February of 2014, our investment simply sits there as the investment firm waits for us to transfer it to another organization and out of its hair. Meanwhile the regional manager has refused to contact us since this last meeting even after we had e-mailed three months ago that our distribution had not been moved to our checking account, as was the agreed procedure. Only after our communication was the distribution correctly moved, with no return confirmation from the manager who instead forwarded our e-mail to the same legal department that the CEO looks to today for investigating our complaint. So basically we have no representation watching over our investment as we wait for FINRA to hopefully give an opinion.

Again, we dropped an investment into this firm because FINRA had been unhappy with our other broker, who had been good to us for over a decade faithfully giving us around a 7% return every single month, even through the crash of 2008. So we decided to try a new broker when one of our former investments had been sold, our getting all our original investment back.

Again, we remind investors to beware after reading our frightening journey with this firm, remembering it also has our checking, savings, will management, and mortgage.

__________________________________________________

Addendum 4

FINRA finally acknowledged our complaint made in 2014 via their letter below dated March 2, 2015, and received on March 9. FINRA writes two things: 1.) that their investigation of our complaint has been closed 2.) and if new information becomes available we can contact FINRA again. We have been waiting since the summer of 2014 to receive only this vacuous letter.

No other information was provided nor did FINRA send us documentation why we were not made aware high stop gap fees would be charged against our account. We discovered several months after our original investment that thousands of dollars had been withdrawn as "fees." This is what had started our original complaint in the first place.

Noting so little information provided by FINRA in this letter, we had been concerned with FINRA's objectivity, discovering through the news media of many elected officials in the U.S. Congress having stock and obtaining profits from the same company we had filed a complaint against. We had invested funds with this corporation because FINRA had a problem with our prime brokerage firm in the Northeast, our having had no complaints with them in the last 15 years.

Yet trying to acknowledge FINRA's concern, we then invested some funds in 2013 with this current broker. We were led to believe by FINRA that moving some of our funds to a different broker would therefore be in safer hands than it had been in since 2002. We are currently awaiting response from a watch dog organization for a second opinion on this matter.

March 10, 2015

Mr. *****************

FINRA

*******************

***********************

New Orleans, LA

*****-****Dear Mr. *********,

Thank you for your recent letter acknowledging you have advised FINRA to close the investigation on our complaint filed last summer, ID: CC-***********.

As you know, I have posted our journey on the Web and have continued to do so, the content of your letter added today to my documentation with names, identifications, and titles eliminated as per the procedure I adopted for placing documents on the Web page shown below. No one knows from that posting whom our dispute is with.

http://www.freedomisknowledge.com/nc/stopgap/investorbewarelg.html

To date no one has supplied documentation that my wife and I were told the suggested stop gap program to save our investment would cost us thousands of dollars each time implemented. People I have talked with are stunned the broker kept re-buying the same stock. If we had been advised at the first stop gap of the fees that were being implemented and then asked if we wanted to continue, we would have rejected being further involved in the program suggested by the broker from day one, asking him to instead look into another REIT, because we found several on our own in late November of 2013.

What is truly amazing is what lengths ******************** has gone to in hiding the fact we were never advised of these fees even after the first time they were initiated without our knowing the cost. After having contacted the CEO of *********** in San Francisco and his sudden lack of interest in our complaint after obviously talking with the advisors’ legal department, it almost looked as if we had stumbled onto a revenue stream from new investors.

I recently contacted a national watch dog group, as noted in the above Web page ahead of your letter. We wait now for their advice. ****** and I are ordinary people who followed FINRA’s suggestion to try another broker outside of ******. Ironically to date it is ****** who has followed their agreement with us for the last 13 years, delivering the agreed-to distribution each month, even in the crash of 2008, then later returning our investment in the sale of **************.

Following FINRA’s concern with ******, we decided to move the sale of ************** to another broker, ****************** in June of 2013 that was near our home. The investment is now worth about $**,*** with the loss including the $6,000 dollars in fees removed by the *********** broker in 2013.

The arrogance and aloofness of ******************** and its legal department is simply astounding. They want us to remove our investment dollars after we’ve lost more than $**,*** under their suggestion investment. ****** in comparison is like night and day to these professionals. As a side note the local manager has not communicated with us in any way for more than a year. Our one e-mail sent to him about 11 months ago was forwarded to *********** legal department, which then generated a request we remove our money. We therefore have no interest in ever hearing from him again.

We will continue this journey, our savings, checking and mortgage still with ***********. We are a good risk. Our credit score around 800, and why ********** probably bought our mortgage independently from another finance company a few years ago.

You need to know we have not been looking forward to FINRA’s assistance after we discovered in the fall of 2014 a warning in the conservative media, which I monitor daily, that many U.S. elected representatives in the U.S. Congress have big investments in ***********.

Thank you again for your letter and please accept our best regards. As normal this will be posted on our Web page with names and company references removed so our continued journey is well documented until it finds a conclusion. We are both former school teachers in the days when they were not paid much, so $6,000 is a lot of money to us, not Obama’s chump change.

****and ***************

************

***********, NC *****

__________________________________________________

Addendum 5

Note: February 18, 2016

The above date marks two years since the broker of this national investment firm has communicated with us in any form, our not being surprised that the stock is now down almost 50% and knowing the full history the original broker had purposely left out of the portfolio he provided when recommending the investment.

As already mentioned FINRA closed it case and continues to refuse to gather proof we were never advised of the fees associated with the original broker's suggestion to protect our investment, which will be three years from this coming June, 2016. As we had mentioned earlier in this document, when we did e-mail the broker with a question two years ago, March 2014, it generated another letter from the firm's legal department to remove our investment. We have now reached our mid 70's.

One well-respected national watchdog agency in Washington, D.C., had advised us that due to revised banking rules coming of out Washington, D.C., the banks that are too big to fail are basically now in bed with FINRA. This is while a well-respected North Carolina watchdog late last year suggested that we sue. Currently with our stock down close to 50% we have no desire to play the game of David and Goliath unless we discover more fees have been removed without our knowledge.

__________________________________________________

Addendum 6

Note: Late Summer, 2016

In the late summer of 2016 we met with a receptionist at the state's U.S. Attorney's Office, who said she would forward a simple message of our years of concern in dealing with our investment firm to their main office. The following week we did receive a call, but instead interested in another case involving a different division of the firm we have been complaining about. The call lasted about 90 seconds.

__________________________________________________

Addendum 7

December 2016

Receiving no further contact after our summer communication, we then sent a printed copy of all the details in this HTML page ending with the February 2016 final update along with a cover letter to the state's U.S. Attorney's Office by registered mail, which was acknowledged as received but with no confirming contact.

Then at the end of the month we strangely, and for the first time, received a Christmas card from the investment firm signed by a name we had never seen before.

__________________________________________________

Addendum 8

January 2017

We went online to check the current balance of our investment and discovered a new broker's name on the online page. Looking back at the Christmas card, it was the same. We had received no notification of any change by our representative at the firm. And other than the above mentioned Christmas card, which could have been sent by a secretary to a list of names, the new broker had also not attempted to contact us.

Since we had received a hostile letter in March of 2014 to remove our funds after trying to contact our assigned broker at the time, we have never initiated contact again, even now, not knowing what the result would be.

__________________________________________________

Addendum 9

May 2017

As an update, it has now been over 38 months since we have been contacted via phone, e-mail, or formal letter by the investment firm other than through our own efforts for monthly electronic online updates to check for distributions or the trading value of our stock at that time.

Also FINRA has never attempted nor has been interested in finding the document that advised us at the time of our sign up in June of 2013 that we would be charged $1,500 for selling and then another $1,500 for reinvesting in the same stock and then for another occasion, resulting in our discovering in November of 2013 an unexpected $6,000 charge against our original investment. That fee structure was never provided to us at the time, which started us on this very long and unwelcomed journey.

__________________________________________________

Addendum 10

September 2017

My wife was sent a survey through our investor's national office with questions to be filled out on her satisfaction with our local service. She decided to e-mail the survey, which had been obviously provided by a third party, marking negative scores since we have not been contacted by our broker's service in over three years. She wanted to see if the survey went back to the national division for checking on their management across the nation or would simply be forwarded to the local branch.

In October she received a letter from the local branch manager dated October 10, 2017, assigning my wife to another assistant broker. Please note I say "another" because in the above content we mentioned that the branch manager had moved our account from his authority to an assistant broker back in 2016 without notifying us. We discovered the change only after receiving a Christmas card with a name on it we didn't recognize. We checked online and there was the new broker's name, who also had not contacted us of his new assignment. It also was the first Christmas card we had received from the institution since our taking out the account.

We also noted on the letter sent to her that the branch manager had refused to physically sign the letter with his name. So everything continues to be as normal.

__________________________________________________

Addendum 11

June 21, 2019

Today and without notice, our REIT that had been purchased at the investment firm suddenly declared a "common stock dividend to be paid on a post one-for-three reverse stock split basis." We were not notified of this, catching it online at a financial site.

The last time we contact our investment firm, or the investment firm had contacted us, was about five years ago. At the time we had received a letter from their legal department in Tennessee that advised us to remove our money from the firm. That was when we had complained to the corporation's president in a certified letter about six thousand dollars in fees we didn't know about, documenting our journey to him that was experienced at his company's local office.

Before that when we wanted proof of the paperwork we had signed acknowledging thousands of dollars would be removed from our account in fees, knowing we were shown nothing when transferring the money to this investment firm. When we later contacted FINRA over the issue, a representative told us everything was in order without again providing any proof we had signed any document acknowledging high fees would be charged to us. We had at that time also put our complaint online in a redacted documentation where no one would know who the investment firm was or who we were. That was done because we realized these events might need to be documented for a later date. For doing this online activity, the same legal department then sent us a similar letter to remove our funds, the other one mentioned above making it now two requests.

In other words, for five years their brokers had not contacted us and we had obviously had not contacted them in trying to avoid a third harassing letter.

So today I reluctantly contacted the broker, advising that our investment had done a reverse stock split and no one had notified us of that activity and what it would mean for our investment. Along with this day's event, we had also noticed that our online investment suddenly showed a value in our portfolio of only a few hundred dollars.

To identify myself, I gave my name and social security number to the broker's local office operator. I waited and was then told that my name was not in their databank and that if we actually had a portfolio with them it would have probably been transferred to a "Call Center." She gave me a phone number and hung up.

I called the phone number of the call center and discovered they did have our investment information. I advised the broker on the phone, which I know was being recorded, that no one had told us we were tossed out of the local office. We also discovered in the conversation that the investment firm had reorganized its online documentation and why when looking at the total portfolio only a hundred dollars was listed. Clicking on the investment tab brought up the value of our investment, which was now down to literally 50% of its original value.

After a long discussion with this broker at the "call center," it was agreed a complaint would be filed on our behalf along with providing the online URL, which documented our six-year journey. We asked our complaint to include the fact that our investment had been moved out of the local office without our knowledge.

Meanwhile the broker at the call center asked what we wanted to do with the 50% we had left in the investment. I said let's handle first the way we had been treated by the investment firm and then deal with the rest later.

We are not encouraged, seeing what this firm did to the folks on their consumer end. The arrogance and disrespect for customers is stunning but not surprising in a world of Mueller, Comey and Weissmann. The canary in the coal mine, Sidney Powell, was loud and clear on the corruption that has been all around us in government and the corporate world.

__________________________________________________

Addendum 12

July 13, 2019

Based on our phone call in Addendum 11 to the investment firm's "Call Center," which again we didn't know existed until we were told by the local office when the receptionist couldn't find our names, we received the following two page letter dated July 10, 2019. Again all reference to the investment firm's name or the employee sending the letter has been redacted.

Note this July 10th letter, received on July 13, says that our account was being serviced by a "Solutions Team." As mentioned in Addendum 11, we had never been advised of a "Solutions Team," the operator at the local office saying it was a "Call Center." After giving her our names, she replied to us there was no record of our investment and that if we believed we had actually invested with the company, we could contact "the call center" where our information might be located.

This phone call to the local office was either on June 21, 2019, or the next business day after, which would have been the 24th.

Note the above July 10th letter includes a statement that our complaint about the stop loss fees had been fully addressed. That is not true. We were never told the fee price nor advised when the fees were being taken out of our account. This was even after four fees had been removed from our account in the amount of $6,000. Those four deductions to our account had never been documented by ANY letter or e-mail sent to us, instead quietly BURIED on their Web site documented in screen shots that are further up on this online complaint. You can see by the images at the time, unless we had been trained, we wouldn't know where to look.

You will note the above July 10th letter also makes reference to a "closed fund research report." For further documentation on our complaint about this "closed fund" report, for this posting I had taken the cover sheet, which included a graph showing the stock over five years, and then put it up against the actual full history of the stock that was never revealed to us by the broker.

Looking at the full history in the overlay graphic below, you can understand why the broker wanted to hide it, hoping we would trust him and not dig any further. Being a customer with savings and checking with the firm, why would we not trust him? Obviously their system was literally "banking" on that.

The comparison of information on the stock being recommended is dramatic, as shown below. The light blue box represents what we were shown by the broker's "closed fund" document against the stock's actual FULL history, a history we discovered on our own.

This journey started when I asked the broker in November of 2013, who was ready to make another stop loss transaction, "Exactly how much is each of these stop loss trades costing us?" That is when he said he had a sick feeling in his stomach after telling me those transactions were for thousands of dollars. But then he said the next one would be free.

I replied there would not be a next one, shocked to hear our account was being raided by fees we were not aware of. I had hoped this could be eventually sorted out, which as of July 2019 has not happened. If the broker had made another stop loss transaction without our knowing the fee structure, the amount removed from our account that was only five months old would have been a "stunning" 10% of our original investment, the sale from another IRA, an investment we told the broker we wanted to protect.

The letter sent to us went out of its way to comment that the company strives "to provide optimal client service," when in fact there had been no contact by the local office since February 2014. Or for that matter the corporate legal office, too, not since they sent us the letters around five years ago that told us to remove our funds. To that end, we checked the annual fees we had been required to pay over those last five years of no contacts, the total coming to $700 for zero communications.

Please note that there was a letter my wife wrote that was never included in this report. She had sent it to the local manager in August of 2016, asking why our fees were being increased when no one in the office had contacted us since February 2014. In the letter she noted the language the company used when sending the invoice to us for the annual fee. It read, "We'll also make sure you understand our fee structure, how much you're paying, and what you're paying for."

She never received a reply.

__________________________________________________

Addendum 13

August 2019 - February 2020

Finally, in the late summer of 2019 we presented our account to our local U.S. House of Representatives. The contact we made reported that the Congressman suggested his office send our complaint to two other agencies in Washington, D.C. To that end we compiled all the documents along with the contents of this Web page and put them into a single binder with a letter of explanation.

We were informed it would be passed to the Treasury Department and then if needed to Consumer advocacy. After a few weeks we were informed that both departments in Washington D.C. had reply that our journey was not in their area of interest. They then passed it back to FINRA. We were told FINRA reported that all was still in order and that they could still do nothing about our complain on the $6,000 in fees. Again FINRA would not provide us with any proof of documents we had signed to approve those fees.

The binder was returned to us in late November in a brown envelope with zero letters attached from the Congressman to those agencies.

Then in February of 2020 we saw a newspaper article that the CEO of our investment firm had been brought up on charges for misrepresenting customers, the arrogance stunning. In response, we sent a certified letter to the Washington D.C. agency responsible for bringing the CEO to justice. Our hope was that maybe they would be interested in our journey, which showed the arrogance of the culture went across the corporation. They weren't.

__________________________________________________

Investor Beware

Background Graphic Sources: | Bilbos Random Thoughts (BoGrace) | Trading Game (Wizard of Id) | Carrier Management (Bird) |